Tata Motors

The company reported a consolidated net profit of Rs. 3,203 crore for the first quarter of fiscal year 2023–24 (Q1 FY14), helped by the increased profitability of its passenger vehicle (PV) business and strong sales at its luxury automobile division, Jaguar Land Rover (JLR). In the quarter under review, operating revenue grew by 42% to Rs 1.02 lakh crore.

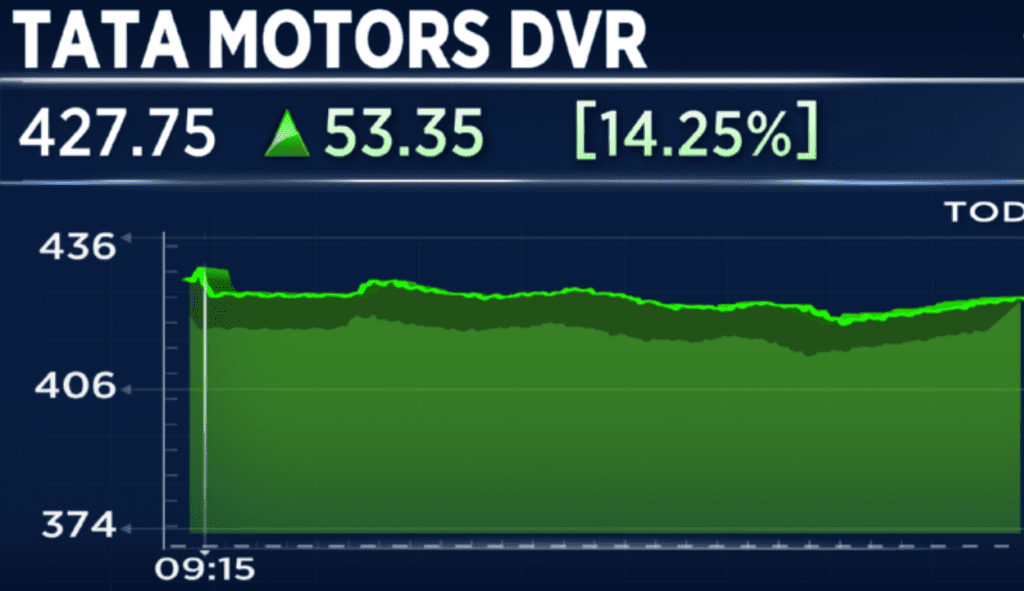

On July 25, Tata Motors announced that the board of directors had authorised a Scheme of Arrangement for the cancellation of ‘A’ Ordinary Shares and the issuance of seven Ordinary Shares for each 10 ‘A’ Ordinary Shares held by shareholders.

The ‘A’ Ordinary Shares have five percentage points more dividend rights and one-tenth the voting power of ordinary shares. On the BSE and NSE, they are listed as Tata Motors DVR. It will be taken off exchange delistings following conversion.

The ‘A’ Ordinary shares were initially issued by TML in 2008, and then again in a QIP in 2010 and a rights issue in 2015.

Since then, restrictions on the issuing of these securities with differential voting rights have been put in place, and TML is still the only sizable listed corporation holding one of these securities.

At the moment, the ‘A’ Ordinary Shares trade at a discount of 43% to Ordinary Shares. According to the corporation, the capital reduction consideration entails a 23 percent premium over the closing share price of ‘A’ Ordinary shares the day before, which translates to a 30 percent discount over the price of Ordinary Shares and is significantly below its historical norms.

According to Tata Motors, the Scheme will increase value for all shareholders by 4.2 percent by reducing the number of outstanding equity shares.

The Scheme also contemplates the establishment of a Trust, with an impartial third party serving as the Trustee, to carry out the numerous procedures necessary to give the Scheme legal effect. The Trust will be given the Ordinary shares that TML issued to the holders of Class “A” Ordinary Shares. The shares will subsequently be issued in accordance with Tata Motors DVR’s present holdings.

The Scheme requires shareholder and regulatory approvals. Citigroup and Axis Capital serve as fairness opinion providers for the ‘A’ Ordinary and Ordinary shareholders, respectively, while PWC serves as the independent registered valuer for the transaction. Tata Motors’ legal counsel for the deal is Cyril Amarchand Mangaldas.